by Appraisal Economics | Oct 28, 2024 | Asset Appraisal, Blog, Taxes

In 2024, new tax consequences are significantly impacting the use of life insurance in succession planning. The recent ruling in Connelly v. United States has reshaped how closely held businesses navigate estate taxes when using life insurance to fund buy-sell...

by Appraisal Economics | Jul 12, 2024 | Stock Options, Taxes, Valuation

The 83(b) election offers a crucial advantage for recipients of restricted tokens – particularly within startups and growth companies. When individuals receive restricted tokens as part of their compensation package, they typically come with vesting conditions that...

by Appraisal Economics | Jul 12, 2021 | Taxes, Valuation

Since taking office, President Biden has made a few stands that surprised the American public. Most recently, he announced a fairly substantial new initiative for the Internal Revenue Service. Along with directional change and increased number of staff comes a hefty...

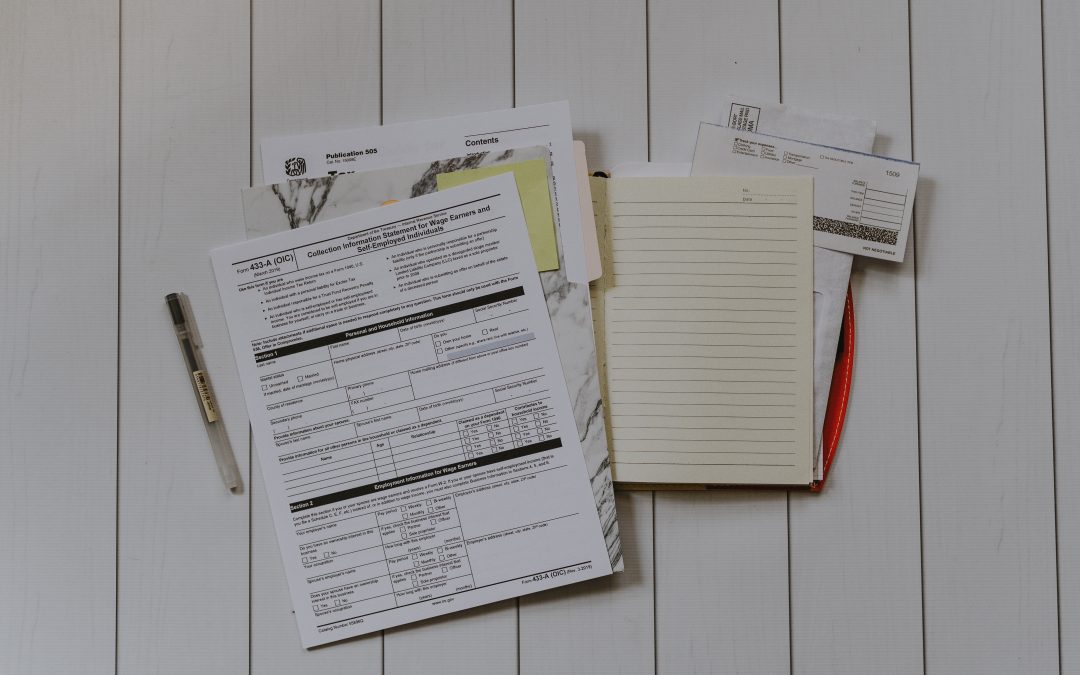

by Appraisal Economics | Dec 17, 2020 | Taxes, Valuation

Political election processes can be a mixed bag of emotions. Anxiety and apprehension are intermingled with both anticipation and excitement. Considering the already tumultuous global conditions, the 2020 election has produced even more turmoil than could have been...

by Appraisal Economics | Mar 24, 2020 | Taxes, Valuation

There are a multitude of reasons to get a business valuation. Determining the tangible and intangible assets of your business is always important, whether you are shaping your business strategy, getting ready to acquire another business, or buying out a partner....

by Appraisal Economics | May 14, 2019 | Business Valuation, Taxes

There are several common tax scenarios that require business owners to determine a justifiable dollar value for their companies. Business valuations are critical for gift and estate tax liability purposes, and/or to engage in the sale of your business. In all of these...