As the values of US-based sports franchises continue to escalate, with the $4.65 billion acquisition of the Denver Broncos serving as the most prominent recent example, North American investors have taken a more global approach to investing in sports assets. European football (soccer) clubs, particularly in England, have proven to be among the most appealing targets. At the top end of the market, such investments often complement holdings in the top US sports leagues. In other instances, investors that might be priced out of the market for US sports franchises see opportunity in lower level football clubs that they believe are undervalued.

While European football clubs in many ways resemble US sports franchises, there are several key differences. Investors steeped in the US sports industry must develop a thorough understanding of the European model and calibrate their investment strategies accordingly.

Opportunity At Home and Abroad

The trends driving valuations of European football clubs are largely the same as those enhancing the value of U.S. sports franchises, namely media rights. Due to the global nature of football, the broadcast rights for the top European leagues (Premier League, La Liga, Bundesliga, Serie A, and Ligue 1) generate substantial revenue abroad. The Premier League has led the pack in this regard, and the league’s international broadcast revenue is set to exceed domestic broadcast revenue for the first time starting with the 2022-2023 season. That’s not to say that domestic media revenue doesn’t remain highly lucrative. Barcelona, one of Europe’s biggest clubs, recently completed a two-stage sale of a 25 percent stake in its La Liga television revenue for 25 years to private equity firm Sixth Street in exchange for a reported €527.5 million.

The global opportunity extends beyond league broadcast revenue. For example, Manchester United, a pioneer in global marketing among football clubs, claims to have 1.1 billion fans and followers. This fan base appeals to international and regional companies around the world, enabling the club to drive sponsorship revenue growth. The club also monetizes its fans directly through the sales of branded apparel and other licensed products. Digital media offers additional opportunities to offer fans subscriptions to club-specific content. While Manchester United operates on a larger scale than most, other top clubs also seek to build a large global following with similar investments in international tours and other global marketing activities.

Traditionally, stadium revenue has largely consisted of matchday revenues from ticket sales, concessions, and hospitality. These revenues are naturally more local in nature, but top clubs with global fan bases have increasingly attracted global tourists to matches. In many respects, such attendees can be more lucrative for the club, as they are more likely to pay a premium for tickets and purchase more merchandise than the local fan that comes out for a regular Saturday afternoon.

Whether it is local fans or tourists filling the stands, a club’s economic arrangement at its home stadium is a key financial driver that can take many forms. For example, West Ham is several years into a 99-year lease at London Stadium, which has financial terms that are reported to be highly advantageous for the club. Chelsea, meanwhile, has fallen behind its rivals in terms of its ability to drive revenue from its Stadium, and the necessary investment in Stamford Bridge was a critical aspect of the club’s recent takeover. Tottenham Hotspur’s new stadium opened in 2019, and the club struck a 10-year deal to host NFL games. Regardless of scale, clubs throughout European football face comparable challenges in determining whether it is best to own or lease their stadium and how to leverage the arrangement to best serve the club financially.

Risks and Challenges

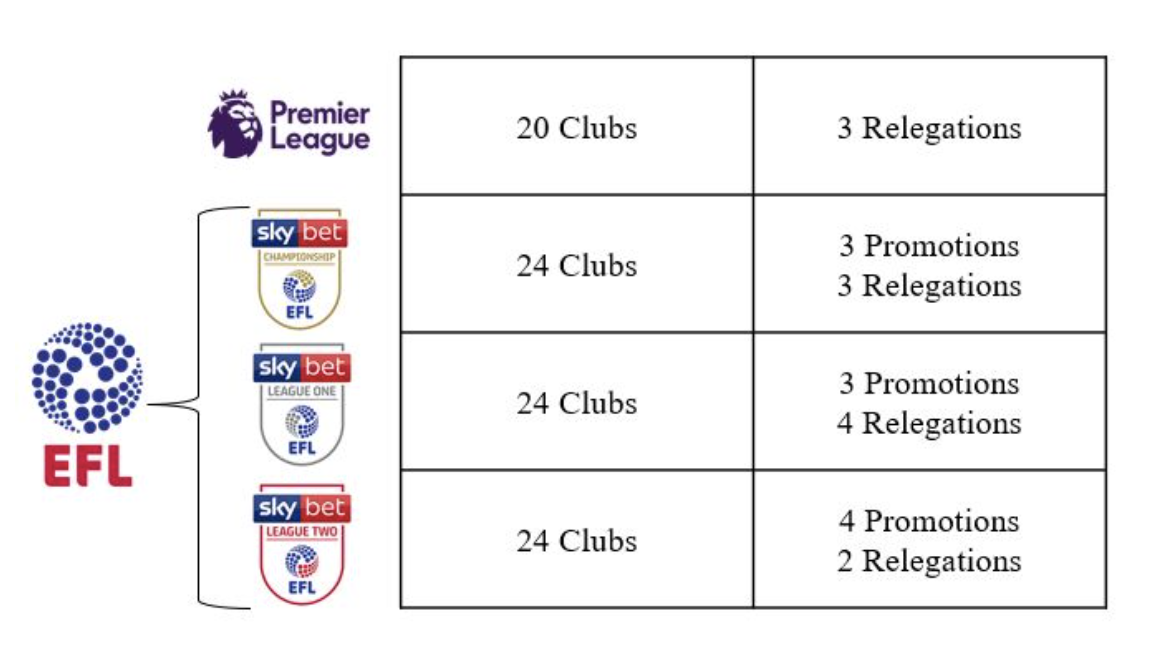

One of the most important differences between U.S. sports and European football leagues is the concept of promotion and relegation. U.S. leagues are closed, meaning that regardless of a team’s performance in any given year, it is guaranteed a spot in the same league the following season (along with the same revenue sharing benefits). Under a promotion and relegation system, teams that finish a season at the top of a lower-level of competition are promoted to the next highest level of competition for the following season, while those that finish at the bottom of the league table are relegated to the tier below. As an example, the promotion and relegation structure for the English football league system is summarized in the following figure.

From a financial perspective, the key implication of promotion and relegation is that a club’s revenues can be highly uncertain, swinging dramatically from one year to the next. While mechanisms such as parachute payments and relegation clauses in player contracts can help soften the financial impact for relegated clubs, a drop from the Premier League to the EFL Championship, for example, will still carry heavy consequences. The revenue gap between the Premier League and the EFL Championship is so pronounced that the final match of the EFL Championship playoffs, from which the winner becomes the final club to be promoted to the Premier League, is referred to as “the richest game in football,” potentially worth hundreds of millions of pounds to the winning side. While a handful of top clubs are essentially insulated from the issues of promotion and relegation, it is critical that investors are realistic about the possibility of both and develop the appropriate financial plan for all scenarios.

Another key area of differentiation relates to the cost of players, whose salaries typically represent the largest expense for any professional sports organization. With the notable exception of Major League Baseball, most U.S. sports leagues negotiate for some type of salary cap in collective bargaining agreements with their respective players’ unions. While the salary cap in the NFL helps make it almost impossible for franchises to lose money, UEFA’s financial regulations (Financial Fair Play and sustainability regulations) are less stringent and can be subject to greater gamesmanship by clubs.

Ultimately, the competitive market for talent can drive players’ wages to the point where club revenues are effectively just being passed through to the players, and often even further. While some clubs aim to run like traditional businesses, they increasingly find themselves competing with sovereign wealth funds, which have different objectives beyond the bottom line and a virtually unlimited budget with which to pursue them. Wage bills have often driven annual losses for football clubs, which would be unthinkable for an NFL franchise that has the cost controls of a hard salary cap.

Finally, the financial performance of European football clubs is limited by one of the factors that make them so valuable to begin with: the relationship with supporters and fans. Football club histories often go back more than 100 years, with deep roots in the community. Club owners are largely seen as stewards of a local institution. Clubs often face severe public backlash if they seek to increase ticket prices too dramatically and potentially price out certain fans. Clubs can be so connected to a place that even moving stadiums within the same city can be painful for supporters.

As a result, the practice of threatening a move to leverage local governments for taxpayer funded stadiums, a common practice in the U.S., is rarely if ever seen in Europe. The threat of relocating a club with such deep community ties is not credible, and ownership would likely never recover from the backlash. Fan passion was similarly on full display when a collection of the biggest clubs in Europe recently moved to form a “Super League.” Backlash was so strong that the project was quickly abandoned (at least publicly, for now).

Every Situation Is Unique

This is hardly an exhaustive discussion of the various factors a North American sports investor must consider when looking at opportunities in Europe. The player transfer market, academy system, and presence of non-league competitions such as the UEFA Champions League all warrant consideration. Further, the circumstances surrounding each individual club are highly nuanced, and the rules (financial and otherwise) applied by various governing bodies are not static. The team at Appraisal Economics is well positioned to provide independent, unbiased analysis of sports investments both in North America and around the world.